How to start your journey in the share market?

The first

thing to do is to learn what is a share? and how does it work?.

Learning

what is a share is the easy part but figuring out how it works is the tough

part where many do not understand that it is a business not betting. You need

to understand that every business has its good days and bad days likewise you

need to figure out how to gain more during good days and how to lose less

during bad days this is the key principle you need to follow to be successful.

The major requirements to start trading in share market are

- Bank account(to transfer money from to share market)

- Kyc documents (to open Demat cum trading account)

- Demat account(to hold your shares)

- Trading account(to buy and sell)

There are mainly 3 types

- Investing

- Day Trading

- Speculating

These 3

styles follow different risk appetites depending on your wrist appetite you can

choose any of the 3 styles and also These 3 styles have different timeframes or

frequencies of trades

Investing

is for low-risk medium gain and the time frame is long like one month to many

years For Example buying equity shares of companies holding it for a prolonged

period

Day Trading

is for medium risk and high gain at the time frame is like one day to few weeks

example intraday trading of equity shares or features buying shares with

leverage

Speculating

is the riskiest of all with the highest gain and the lowest time frame For Example

buying and selling options where you pose the risk of losing your entire

capital within a brief period or you may gain profit more than your first

investment

For

beginners it is best to choose investing which is very less time consuming and

less risky also it provides a good returns and you can Start learning how to

invest and slowly gain knowledge about the share market you can start with a

very low capital So that you won't lose much avoid speculating and following

tips of others till you acquire the basic knowledge on how the market works

after that you can start exploring leverage trading once you gain good

confidence about your trades follow strict principle of having a stop loss to

protect your investment from sudden movements of the market this will protect

your investment from huge losses Always remember that you cannot make profits every

day you need investment protected to trade another day The best principle to

follow here is having a 2:1 ratio for profit versus losses this will give you a

discipline and also make you consistent when following a trading style there

are enormous number of trading styles and strategies you can follow to make

consistent profits by following the rules to one ratio you will make profit

even though if you are successful in 5 out of 10 trades

Coming to

speculation this is more lucrative and looks quite easy for most traders but

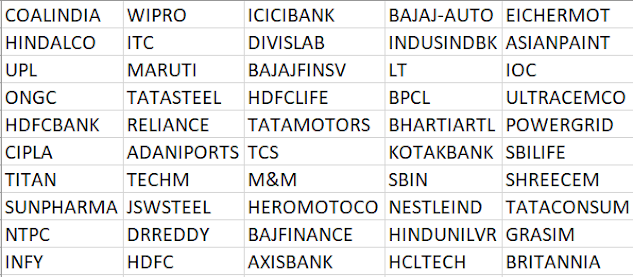

it's a deadly trap for many. Speculation is mostly done on nifty and bank nifty

options Where people have equal opportunity to either make 100% profit or lose

100% capital this is the riskiest means of making money in the share market one

large trade can wipe out your entire capital or it can make you rich what is

this purely on probability so it is wise to avoid making huge investments

invest only the amount which you are ready to lose So that it won't make a dent

in your investment strategy

There are

many books you can refer to learn about his trading styles and also there are

many YouTube videos made for beginners My strong advice is that you start by investing

and learn more about the tricks and trends of the market Also I will provide

you with knowledge of value investing in the future blog posts through which

you can become a value investor yourself By following the key concept involved

in understanding a company’s valuation

And learn more about Value investing which is the key strength of the greatest

investors like Warren buffet

Comments

Post a Comment