Nifty 50

What is Nifty 50 ?

Most people who are new to share market or watch news have wondered what is Nifty 50 ? , what does it represent? and what is the basis of its calculation?.

Nifty is the name derived from N(National Stock Exchange) and ifty(Fifty stocks in the index).

An Index is a list of stocks grouped to form a particular Index like Nifty 50 (group of 50 stocks)which represents the performance of the Share market which in turn represents the strength of the Economy of a country. In most cases it serves as a benchmark for investment , Economic growth, stability and ease of business in a country.

The NIFTY 50 is owned and managed by NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL), India’s first specialized company focused on an index as a core product.

Now coming to Nifty 50 it has a group of 50 stocks whose price is calculated using the free-float market capitalization weighted method wherein the level of the Index reflects the total market value of all the stocks in the Index relative to the base period November 3, 1995. The total market cap of a company or the market capitalization is the product of market price and the total number of outstanding shares of the company.

Market Capitalization = Shares outstanding * Price

Free Float Market Capitalization = Shares outstanding * Price * IWF

Index Value = Current Market Value / Base Market Capital * Base Index Value (1000)

Base market capital of the Index is the aggregate market capitalization of each scrip in the Index during the base period. The market cap during the base period is equated to an Index value of 1000 known as the base Index value.

In easy terms Nifty 50 index moves in correlation with the stocks present in the index,

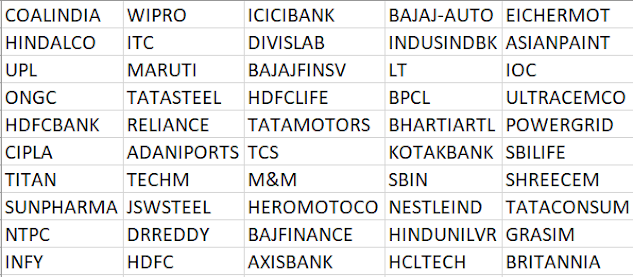

here is the list of stocks in Nifty 50 .

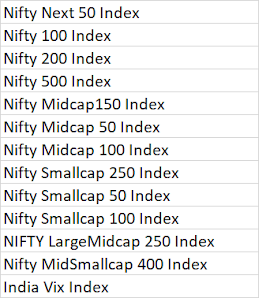

Now that you have understanding of Nifty 50 index there are few more indexes of Nifty which are

There also some specialized indices which have a very specific group of stocks.

Sectoral Indices

Sector-based index are designed to provide a single value for the aggregate performance of a number of companies representing a group of related industries or within a sector of the economy.

Thematic Indices

Thematic indices are designed to provide a single value for the aggregate performance of a number of companies representing a theme.

Strategy Indices

Strategy indices are designed on the basis of quantitative models / investment strategies to provide a single value for the aggregate performance of a number of companies.

Fixed Income Indices

Fixed income index is used to measure performance of the bond market. The fixed income indices are useful tool for investors to measure and compare performance of bond portfolio. Fixed income indices also used for introduction of Exchange Traded Funds.

Hybrid Indices

NIFTY Hybrid Index series seeks to track the performance of a hybrid portfolio having pre-defined exposure to equity and fixed income assets.

The major and highly traded index in Nifty is the sectoral index Bank Nifty.

Comments

Post a Comment